The Indian credit card market is evolving rapidly, with co-branded credit cards emerging as a powerful tool for retailers and brands to deepen customer engagement, boost sales, and build loyalty. According to industry reports, co-branded credit cards now account for around 12-15% of the market share in India and are expected to grow to over 25% by 2028, with an annual growth rate of 35-40%-significantly outpacing traditional credit cards.

Why Tie-Ups with Credit Cards and Banks Make Business Sense

- Drive Higher Customer Spend and Loyalty

Co-branded credit cards encourage customers to spend more frequently with the partner brand by offering exclusive rewards, cashback, discounts, and personalized offers. For example, the Swiggy HDFC Bank Credit Card incentivizes food lovers with cashback on every order, enhancing customer retention and increasing average transaction size. Similarly, Amazon’s ICICI Bank co-branded card offers Prime members 5% cashback, driving repeat purchases on the platform. - Access to a Targeted and Engaged Customer Base

Banks and credit card issuers bring a ready pool of credit-worthy customers. Retailers gain access to this audience through the partnership, enabling targeted marketing and acquisition of high-value customers. For instance, travel brands like IndiGo and IRCTC have successfully partnered with HDFC Bank and SBI Card respectively to launch co-branded cards that attract frequent flyers with travel-specific benefits. - Enhanced Brand Visibility and Credibility

Aligning with reputed banks enhances a brand’s credibility and trustworthiness. The association signals financial stability and customer-centricity, which can be a strong differentiator in competitive markets. - Valuable Consumer Insights and Data Analytics

Co-branded cards generate rich data on customer spending patterns, preferences, and behaviors. Brands can leverage these insights to craft personalized marketing campaigns, optimize product offerings, and improve customer experience. - Additional Revenue Streams and Cost Efficiency

Brands often receive a share of the revenue generated from card fees, interest, and transaction charges. Moreover, the bank handles credit risk, billing, and customer service, allowing retailers to focus on their core business with lower operational costs. - Seamless Customer Acquisition and Onboarding

Digital onboarding and integration with banks’ credit scoring models enable faster, low-cost customer acquisition. FinTech partnerships have helped scale co-branded card issuance rapidly, with some programs issuing over 600,000 cards in three years.

Examples of Successful Co-Branded Credit Card Partnerships in India

- Swiggy HDFC Bank Credit Card: Offers cashback on food delivery, attracting frequent users and increasing order frequency.

- Amazon Pay ICICI Bank Credit Card: Provides 5% cashback for Prime members, driving higher engagement and loyalty on Amazon’s platform.

- IndiGo HDFC Bank Credit Card: Rewards frequent flyers with points and travel benefits, strengthening customer retention in the aviation sector.

- IRCTC SBI Card: Offers accelerated rewards on railway bookings and dining, catering to millions of train travelers across India.

- MakeMyTrip ICICI Bank Credit Card and EaseMyTrip Standard Chartered Credit Card: Enhance travel bookings with exclusive discounts and rewards, boosting customer retention in the travel industry.

- Flipkart Axis Bank Credit Card: Offers 5% cashback on Flipkart purchases, popular among shopping enthusiasts.

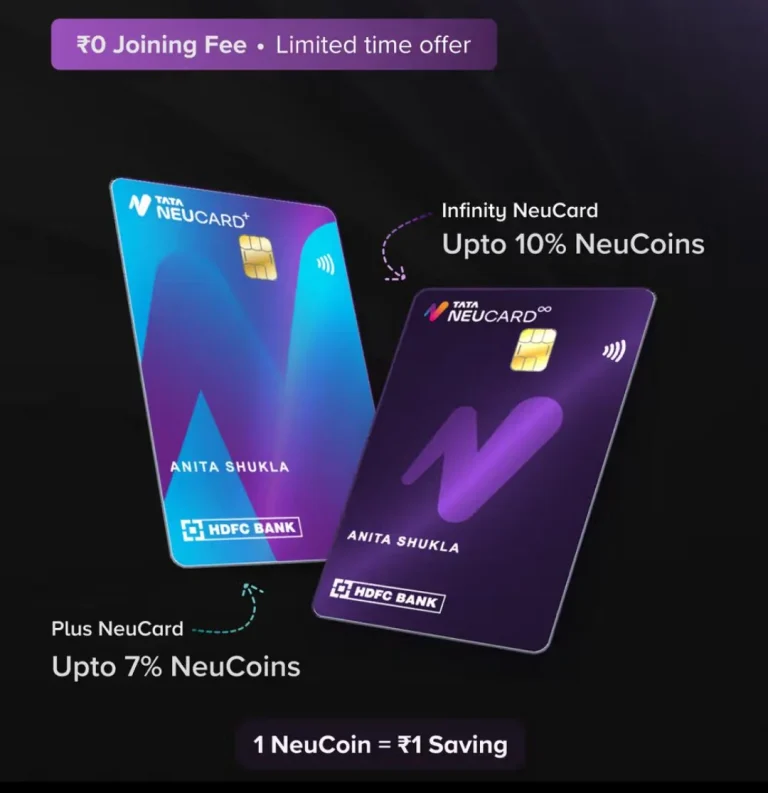

- Tata Neu HDFC Bank Credit Card: Offers 5% back as NeuCoins on Tata Neu and partner Tata brands, with over 500,000 cards issued in recent months, making it one of the fastest-growing co-branded cards.

- Yatra SBI Cardand MakeMyTrip ICICI Bank Credit Card: Target travel customers with rewards and discounts on bookings.

- EazyDiner IndusInd Platinum Credit Card: Caters to food lovers with dining rewards and complimentary Prime membership.

The Future Outlook

With India’s credit card market growing at a CAGR of around 17% and co-branded cards outpacing this growth, the partnership model offers immense potential. Younger consumers especially value co-branded cards for their tailored rewards and brand affinity, making them an essential tool in customer engagement strategies.

Retailers and brands that strategically partner with banks and credit card issuers can unlock new revenue streams, deepen customer loyalty, and gain a competitive edge in a rapidly digitizing economy.